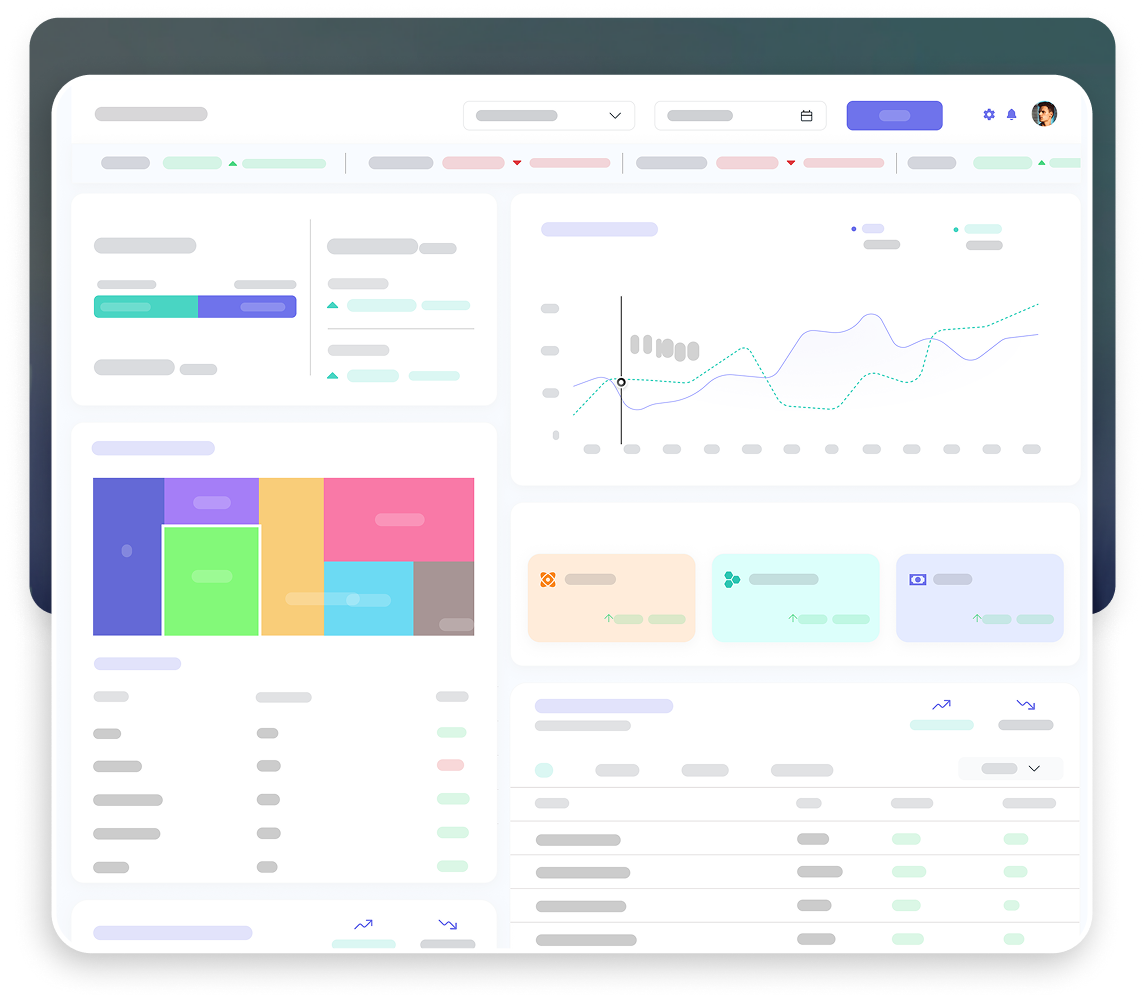

Order management system

Raise basket orders with pre‑trade checks, allocations, and FIX routing in one flow.

Why an integrated OMS

Automated Trade Flow

Automate the full workflow from portfolio change to settlement, minimizing manual handoffs and reconciliation effort.

Smart Portfolio Platform

Manage portfolios and product schemes in one place, creating orders from model portfolios or bespoke mandates without leaving the console.

Automated Risk Guardrails

Enforce risk and mandate guardrails pre‑trade so orders are compliant by design, not after the fact.

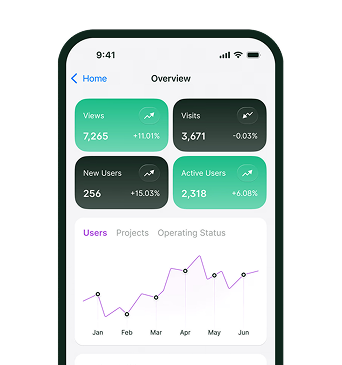

Why TradeGanit vs patchwork tools ?

Whether you’re a Broker or part of a PMS house, TradeGanit adapts to your approach. Here’s how.

True STP:

Connect custodians, brokers, distributors, and exchanges for straight‑through processing and fewer breaks.

Policy‑driven operations:

Configurable rules, approvals, and audit trails reduce operational load and review cycles.

Open integrations:

SDK/APIs and directories for brokers/custodians ensure fast routing and post‑trade updates.

Frequently Asked Questions

TradeGanit answers to common questions from smart

communicators like you.

Yes—EOD files, reconciliations, and contract‑note‑driven updates are part of the standard flow.

Yes—raise from model deltas or issue bespoke tickets per client/scheme.

Pre‑trade checks enforce guardrails; overrides require approver and rationale with full audit.

Yes—straight‑through automation cuts manual steps so teams focus on exceptions, not busywork.

Start Making Growth

Managing your daily activities has never

been easier with these powerful.